breplica.site

Categories

Time Schedule Program

TimeTap is a powerful and feature rich appointment scheduling software solution for the entire enterprise. You'll create more time with our automated tools. Scheduling. Time Tracking. Time Off. Automation. Mobile App. breplica.site has been upgraded and designed for speed, efficiency, and usability. Top 9 Scheduler Software & Tools in - Best Scheduler software reviews, alternatives, comparisons, and promo/discount codes, and ratings - Which. Your complete scheduling toolkit. · Use templates or auto-scheduling to optimize your shifts. · Track availability and time off to avoid scheduling conflicts. School scheduling software for Mac, PC, tablet and phone. Create master school schedule and share. Free sign up. Unique automatic timetable generator. Sling is a free and easy to use employee shift scheduling and planning software that helps your business manage shifts and communicate with employees. Scheduling Software · Visual Planning · Resource Guru · When I Work · Service Fusion · SUMO Scheduler · Connecteam · Sockeye · Kickserv. QuickBooks Time employee scheduling software makes it easy to build and share schedules with employees, assign jobs and shifts, and keep your workforce. Calendly (Web, iOS, Android). Calendly, our pick for the best meeting scheduler app for simplified scheduling. Calendly pros. TimeTap is a powerful and feature rich appointment scheduling software solution for the entire enterprise. You'll create more time with our automated tools. Scheduling. Time Tracking. Time Off. Automation. Mobile App. breplica.site has been upgraded and designed for speed, efficiency, and usability. Top 9 Scheduler Software & Tools in - Best Scheduler software reviews, alternatives, comparisons, and promo/discount codes, and ratings - Which. Your complete scheduling toolkit. · Use templates or auto-scheduling to optimize your shifts. · Track availability and time off to avoid scheduling conflicts. School scheduling software for Mac, PC, tablet and phone. Create master school schedule and share. Free sign up. Unique automatic timetable generator. Sling is a free and easy to use employee shift scheduling and planning software that helps your business manage shifts and communicate with employees. Scheduling Software · Visual Planning · Resource Guru · When I Work · Service Fusion · SUMO Scheduler · Connecteam · Sockeye · Kickserv. QuickBooks Time employee scheduling software makes it easy to build and share schedules with employees, assign jobs and shifts, and keep your workforce. Calendly (Web, iOS, Android). Calendly, our pick for the best meeting scheduler app for simplified scheduling. Calendly pros.

Employee scheduling software with smarts · Control costs with real-time data on wages vs sales · Create AI optimized schedules with a single click · Fill empty. ScheduleBase has been used to schedule over , employees and million daily work schedules. “We used to get hand-delivered notes for time off and. or fewer employees? TCP offers time tracking and scheduling purpose-built just for you. LEARN MORE. Plan your workforce with agility and confidence while reducing the amount of time you spend creating and maintaining schedule with automation. Manage time and. When I Work is easy-to-use employee scheduling, time tracking, and payroll software. Simplify the shift and start your free day trial today! ZIP Schedules Mobile App. Manage your work schedule remotely and increase visibility with ZIP Schedules Mobile App. Access your work schedule anytime from any. It allows managers to create schedules, assign shifts, and make changes in real-time, while also providing employees with visibility into their schedules and. Our Top Tested Picks · Deputy · Humanity · Shiftboard · When I Work · APS OnLine · HotSchedules · Kronos Workforce Ready · Snap Schedule. Free for teams of 5 or less. · Time and attendance tracking, for free. · Manage your employees from anywhere. · Join thousands of businesses already scheduling. Explore shift scheduling software that streamlines workforce & team scheduling, reduces costs, enhances efficiency and boosts employee engagement. Try Clockify — an employee & project scheduling software that lets you create projects, edit schedules, visualize shifts and track time. Employee Scheduling the fast, easy & affordable way - unique advanced employee scheduling system keeps your employees happy and saves you time and money. Gantt is the traditional view for task management and seeing the project schedule. Resource management features like workload or time tracking will help you. Picktime is a free online appointment scheduling software and a booking management system that manages your appointments, classes, group bookings. 7 Best Scheduling Software of ; Best All-Around Option: Microsoft Outlook ; Best Budget Option: ZoHo Calendar and ZoHo Bookings ; Best for Google WorkSpace. Doodle is the fastest and easiest way to schedule anything — from meetings to the next great collaboration. Scheduling Automation software is a tool designed to automate and streamline the process of scheduling and managing appointments, meetings, tasks. In any company, choosing an effective and collaborative scheduling software is essential for improving the day-to-day time management and productivity. Just in. + small (but mighty) businesses use Homebase to manage their hourly teams, with employee scheduling, time clocks, payroll, HR and more. Acuity Scheduling is customizable appointment scheduling software made easy, automating your workflows, payments, and bookings. Start a free trial today!

Student Loan Reimbursement Benefit

Citizens offers businesses student loan assistance with its Citizens Student Loan Debt Management Program. With the program, employees can see if a Citizens. This benefit helps employees pay down their student loan debt faster and enables employers to take advantage of the tax-free benefit of up to $5, annually. Through , employers can continue to make contributions of up to $5, per employee annually toward student loan assistance without raising the employee's. Many federal jobs qualify for student loan debt repayment help up to $10, per year. Under 5 U.S.C. , agencies may repay the student loans of federal. Yes, some companies do offer student loan repayment assistance as a benefit. This usually means they contribute a certain amount towards. A leading provider of solutions that help companies support employees and working families, Bright Horizons offers a student loan repayment benefits program. Customize your benefits, maximize your impact. · Our exceptional service means less stress for you. · EXPLORE THE GRADIFI SUITE OF SOLUTIONS · You can help. Employers use our suite of education benefits programs to help pay employees' student loans and reimburse tuition costs, boosting retention. This budget-friendly option allows employees to earn employer contributions to their retirement account by paying off their student loans. Details. Compare. Citizens offers businesses student loan assistance with its Citizens Student Loan Debt Management Program. With the program, employees can see if a Citizens. This benefit helps employees pay down their student loan debt faster and enables employers to take advantage of the tax-free benefit of up to $5, annually. Through , employers can continue to make contributions of up to $5, per employee annually toward student loan assistance without raising the employee's. Many federal jobs qualify for student loan debt repayment help up to $10, per year. Under 5 U.S.C. , agencies may repay the student loans of federal. Yes, some companies do offer student loan repayment assistance as a benefit. This usually means they contribute a certain amount towards. A leading provider of solutions that help companies support employees and working families, Bright Horizons offers a student loan repayment benefits program. Customize your benefits, maximize your impact. · Our exceptional service means less stress for you. · EXPLORE THE GRADIFI SUITE OF SOLUTIONS · You can help. Employers use our suite of education benefits programs to help pay employees' student loans and reimburse tuition costs, boosting retention. This budget-friendly option allows employees to earn employer contributions to their retirement account by paying off their student loans. Details. Compare.

An employer student loan repayment program provides workers with financial assistance to pay down loans more quickly while helping employers to attract top. The Tax Code provides certain tax-free benefits, should the employer choose to adopt plans, that enable the payment of up to $5, per year as a reimbursement. Through RISLA'S Employer Student Loan Repayment Program, we collaborate with companies to provide tax-free student loan repayment as an employee benefit. Here. The Public Service Loan Forgiveness (PSLF) Program forgives the remaining balance on your Direct Loans after you've made monthly payments under a qualifying. Tuition reimbursement programs, on the other hand, typically cover only tuition and related expenses for courses taken while employed. Employer student loan repayment is where an employer can pay up to $ per year towards an employee's student loans, tax-free. Learn more from SoFi. The student loan benefit is double tax-exempt, meaning neither the employee nor the employer must pay tax on the contribution. That's amazingly tax efficient. The student loan reimbursement pilot has been made permanent and moved into the main body of the contract. However, it is up to each agency if they would like. Note that you cannot receive reimbursement from both the student loan assistance program and the education assistance benefit in the same calendar year. There. Employees with student loans often have to choose between paying off their student debt and contributing to their retirement plan. With this provision. Any employer can offer it to any employees who have student loan debt, or to a specific subset of employees. For example, an employer could offer student loan. The maximum forgiveness amount is either $17, or $5,, depending on the subject area taught. If you have eligible loans under both the Direct Loan Program. How it works. You can apply to participate at any time. Fidelity will make $ monthly payments directly to your student loan servicer beginning in the month. More and more employees are entering the workforce with student loan debt. Our employer-assisted student loan repayment program allows you to help your. Student loan repayment & tuition assistance benefits assist employees in managing their student debt and paying for the costs of education. To benefit from PSLF, you need to repay your federal student loans under an IDR plan. New to PSLF? Check out our 4 beginner tips for PSLF success. If you're. Two-thirds of college graduates leaving school in had an average student loan debt of $29, benefit plan documents for Section Cafeteria plans and. Operating units in Commerce may offer to repay student loans as an incentive to recruit or retain highly qualified candidates or employees. Your operating unit. You may receive up to $10, per calendar year for a total of $60, per employee. The Department will make student loan payments directly to the loan holder. Employers and employees alike greatly benefit from the passage of this act. Employers are now able to make payments toward their employees' student loans on a.

Donating Plasma How Much Do You Get

Type AB plasma donations – which the Red Cross calls “AB Elite” – can be made every 28 days, up to 13 times per year. The average donation takes one hour and You can request cash from a bank teller at any Mastercard member bank. Just remember to bring your card and ID of course. You'll be able to request a cash. Rasure says that the local plasma center she uses allows people to go twice a week to donate, and that you can earn up to $ in the first month. She makes. All Héma-Québec's centres are dedicated to safely collecting blood products, including plasma. In these comfortable settings, you will receive caring and. MONEY: ▻Find The Best Online - Three Providers In This Video - CSL Plasma New Donor Incentives - How Often Can I Donate? Why not take my plasma from my whole blood donation? When you make a plasma donation, you donate approximately two to three times the amount of plasma than. You can earn up to $50 for each new donor you refer. How You Get Paid. Octapharma pays for your time with extremely competitive donor payments. You can donate plasma more often than you can donate blood, because the recovery time is shorter. Many of our plasma donors donate up to 6 times per year. You can expect to be paid anywhere from $20 to $50 per donation. The range in compensation is related to the volume of plasma you're able to. Type AB plasma donations – which the Red Cross calls “AB Elite” – can be made every 28 days, up to 13 times per year. The average donation takes one hour and You can request cash from a bank teller at any Mastercard member bank. Just remember to bring your card and ID of course. You'll be able to request a cash. Rasure says that the local plasma center she uses allows people to go twice a week to donate, and that you can earn up to $ in the first month. She makes. All Héma-Québec's centres are dedicated to safely collecting blood products, including plasma. In these comfortable settings, you will receive caring and. MONEY: ▻Find The Best Online - Three Providers In This Video - CSL Plasma New Donor Incentives - How Often Can I Donate? Why not take my plasma from my whole blood donation? When you make a plasma donation, you donate approximately two to three times the amount of plasma than. You can earn up to $50 for each new donor you refer. How You Get Paid. Octapharma pays for your time with extremely competitive donor payments. You can donate plasma more often than you can donate blood, because the recovery time is shorter. Many of our plasma donors donate up to 6 times per year. You can expect to be paid anywhere from $20 to $50 per donation. The range in compensation is related to the volume of plasma you're able to.

Learn how to donate plasma for the first time. Find more about CSL's donor-focused plasma donation process, qualifications, and how to get compensated. When you make a plasma donation, you donate approximately two to three How often can I donate plasma? You can donate plasma every 28 days. Please. How often can I donate blood? · The minimum donation frequency for whole blood donation in the United States is every 56 days. · Plasma donors may donate as often. How often can I donate? Plasma donation centers may advertise compensation for two donations in one week (seven days). There is no limit to the number of. Biomat USA's exact donor compensation varies by location, but it generally pays $ to $ per month for regular plasma donations. You'll earn. donate whole blood, you should be eligible to donate plasma*. *Women who have previously been pregnant may not be eligible to donate plasma. During. plasma donation can take much longer than return visits or any blood donation visit. If you're interested in becoming a plasma donor, find a donation center. Plasma donations in Everett WA. Allergic & autoimmune donors needed. Apply today to be screened for program. Eligible donors earn up to $ per donation. do not speak to consumer welfare because neither we nor the consumer understands the true cost of donating plasma. There have long been concerns that. You may donate plasma as often as every 28 days. Double red blood cell During this time, you cannot make other types of blood donations. Your body. donors, patients, and team members have shared with us. I started donating because I lost my job – it's helping others, it's easy money. By doing this, I. New plasma donors can earn over $ during the first 35 days! In addition to getting paid for each plasma donation, you can make even more money during. You can request cash from a bank teller at any Mastercard member bank. Just remember to bring your card and ID of course. You'll be able to request a cash. After each successful donation, you will be paid between $$60 in NYC and between $$ in Florida. We hope to see you soon! Each donation yields approximately to milliliters of plasma. Federal regulations allow individuals to donate plasma as often as twice in seven days if. How do you get my plasma? Donating plasma is similar to giving blood. A needle is placed into a vein in your arm. Plasma is collected through a process call. Plasma donors should weigh at least pounds or 50 kilograms; Must pass a medical examination; Complete an extensive medical history screening; Test non-. Medications taken on a regular basis that exclude you from donating plasma Do you have the profile we're looking for? Video. Donors with blood types. A+. A single AB Elite donation can provide up to 4 units of plasma to patients in need, giving you the power to make an even greater impact. Do not use tobacco for at least 30 minutes after donating. Avoid any strenuous activity for at least 24 hours. How often can I donate plasma? ABO Plasma.

Can I Change My Life Insurance Policy

Fortunately, the majority of term life policies offer “riders” that allow you to convert your term life policy to a whole life policy if you wish. You can check. Beyond that, there is no opportunity to reinstate the policy and coverage remains terminated. Q: Get a duplicate copy of my policy? A: Call us or complete the. Do you have enough life insurance coverage? Should you update your policy based on life changes? Find out when and how to change your life insurance today. However, the insurance company will change your premium if you extend. While this can make sense for some people, it may not be the best choice for most. (We'll. I TOOK OUT A LIFE INSURANCE. POLICY ON MY CHILD WHO IS NOW. GROWN AND THE INSURANCE. COMPANY IS SAYING I CANNOT. CHANGE THE BENEFICIARY. CAN. THEY DO THAT? A. Many insurance companies offer policyholders the option to customize their policies to accommodate their needs. Riders are the most common way policyholders may. What if I want to change or convert my life insurance policy? You may have options available to you if your needs change during the term of your policy. You. Yes. To change the owner of your life insurance policy, contact us. You can also download, complete and return this Owner Transfer form. Alternatively, your life changes might allow you to lower your life insurance coverage and premiums. The mortgage might be paid, you might have retired or your. Fortunately, the majority of term life policies offer “riders” that allow you to convert your term life policy to a whole life policy if you wish. You can check. Beyond that, there is no opportunity to reinstate the policy and coverage remains terminated. Q: Get a duplicate copy of my policy? A: Call us or complete the. Do you have enough life insurance coverage? Should you update your policy based on life changes? Find out when and how to change your life insurance today. However, the insurance company will change your premium if you extend. While this can make sense for some people, it may not be the best choice for most. (We'll. I TOOK OUT A LIFE INSURANCE. POLICY ON MY CHILD WHO IS NOW. GROWN AND THE INSURANCE. COMPANY IS SAYING I CANNOT. CHANGE THE BENEFICIARY. CAN. THEY DO THAT? A. Many insurance companies offer policyholders the option to customize their policies to accommodate their needs. Riders are the most common way policyholders may. What if I want to change or convert my life insurance policy? You may have options available to you if your needs change during the term of your policy. You. Yes. To change the owner of your life insurance policy, contact us. You can also download, complete and return this Owner Transfer form. Alternatively, your life changes might allow you to lower your life insurance coverage and premiums. The mortgage might be paid, you might have retired or your.

In many cases, it is possible to change your life insurance policy. Whether you want to increase cover, or reduce the policy length, there are plenty of ways. You can change the amount of your premiums and death benefit. But any changes you make could affect how long your coverage lasts. If your premiums are lower. However, the insurance company will change your premium if you extend. While this can make sense for some people, it may not be the best choice for most. (We'll. If you find another provider who offers a better deal, changing shouldn't be a problem. Or you might find a provider who offers a very specific kind of cover. Can you switch life insurance companies? Of course, but first consider your needs and the outcome like a new medical exam, additional upfront fees. Read on. If the insured person is still alive at the end of the term, you do not get your money back. A term insurance policy is over unless you can renew the policy. If. However, you should be aware that extending your life insurance could affect the amount that you pay, and we would have to assess any change request based on. Convertibility is a policy provision that lets you change your term insurance into a permanent whole life policy later on – without having to get a new medical. Can you change beneficiaries? In most cases, you may change the beneficiaries named on a life insurance policy or other financial account at any time. Changing. The policy term can be changed by the policyholder by contacting the insurer and requesting the change. The policyholder may be asked to fill out an application. You can cancel or decrease your coverage at any time. You cannot increase your coverage after you retire. Can I change my life insurance premiums? Can I change my mind after I purchase a policy? +. You will have a period Should I replace my existing life insurance policy? +. Replacing an. This is called incontestability. If you change companies or policies, you may be required to go through another two year period in which the company could deny. Converting Term Life Coverage to a Whole Life Insurance Policy · Converting term life insurance to permanent coverage can be done without a medical exam. · Beyond. What if I decide to cancel my coverage, can I get my money back? If you cancel your policy within 31 days of enrollment, you will receive a full refund of the. Beyond that, there is no opportunity to reinstate the policy and coverage remains terminated. Q: Get a duplicate copy of my policy? A: Call us or complete the. The downfall is you'll be older which means it will be more expensive and if your health has negatively changed it will be more expensive, or even worse you. Changing the beneficiary on a life insurance policy is pretty simple, as long as you are the owner. Only the owner of a life insurance policy. First of all, anybody can change their life insurance company at any time, but, of course, there is not any guarantee that your new application. In most cases, yes, you can change your auto insurance policy whenever you want – you don't have to wait until the policy renewal period.

Roth Ira With Best Interest Rate

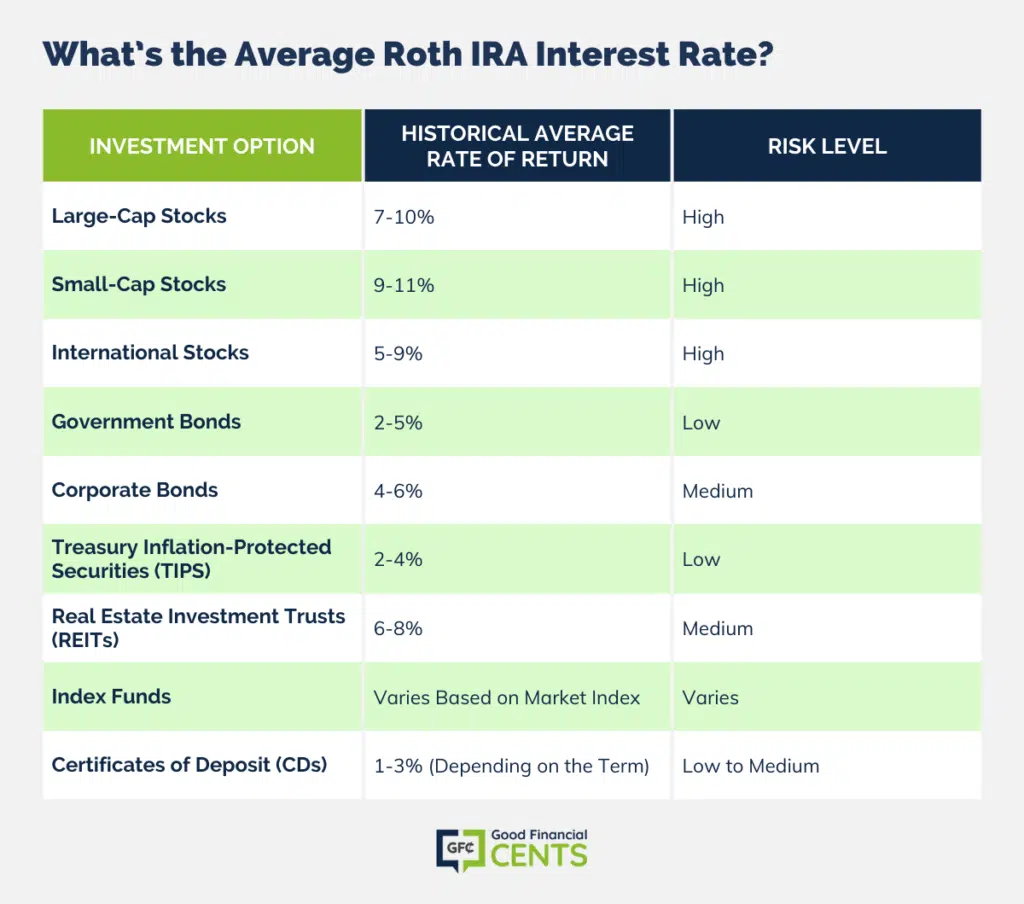

Great interest rates — consistently among the best in the country · No minimum balance requirement. · Ability to withdraw contributions any time without IRS. An IRA CD is a safe, FDIC-insured investment that combines the tax benefits of a traditional or Roth IRA with the predictable interest income of a certificate. The 10 best Roth IRAs ; Interactive Brokers · Yes ; Firstrade Roth IRA · 0% ; TD Ameritrade Roth IRA · 0% ; Charles Schwab Roth IRA · 0% ; Fidelity Roth IRA · 0%. Discover high rates and low risk with our IRA CDs. Choose between traditional or Roth IRA retirement accounts, compare rates, calculate earnings and more. Roth IRA Certificate · Earnings are tax-free · No age limit on contributions · No required distribution at age 72 · Up to % APY with dividends paid monthly. Roth IRA. Your interest and dividend earnings are tax-deferred, and all qualified withdrawals are tax-free A Roth IRA is an individual retirement account (IRA) you fund with after-tax dollars. Your investments have the potential to grow tax-free and may be withdrawn. Visit Citizens to learn about available IRA accounts, including IRA Savings plans and CDs. View IRA rates, compare benefits and open an IRA account today. Best for: Retirement savings with the ability to raise your CD rate. Roth IRA contributions are not tax-deductible. SEP IRA. Best if: You're a. Great interest rates — consistently among the best in the country · No minimum balance requirement. · Ability to withdraw contributions any time without IRS. An IRA CD is a safe, FDIC-insured investment that combines the tax benefits of a traditional or Roth IRA with the predictable interest income of a certificate. The 10 best Roth IRAs ; Interactive Brokers · Yes ; Firstrade Roth IRA · 0% ; TD Ameritrade Roth IRA · 0% ; Charles Schwab Roth IRA · 0% ; Fidelity Roth IRA · 0%. Discover high rates and low risk with our IRA CDs. Choose between traditional or Roth IRA retirement accounts, compare rates, calculate earnings and more. Roth IRA Certificate · Earnings are tax-free · No age limit on contributions · No required distribution at age 72 · Up to % APY with dividends paid monthly. Roth IRA. Your interest and dividend earnings are tax-deferred, and all qualified withdrawals are tax-free A Roth IRA is an individual retirement account (IRA) you fund with after-tax dollars. Your investments have the potential to grow tax-free and may be withdrawn. Visit Citizens to learn about available IRA accounts, including IRA Savings plans and CDs. View IRA rates, compare benefits and open an IRA account today. Best for: Retirement savings with the ability to raise your CD rate. Roth IRA contributions are not tax-deductible. SEP IRA. Best if: You're a.

Roth IRAs are funded with after-tax dollars and provide tax-free withdrawals in retirement. · Stocks, bonds, mutual funds and other securities can be held in a. However, during periods of high interest rates, high-yield savings accounts can have returns from %. Conversely, when you invest in stocks, bonds and mutual. Our Roth IRAs offer competitive interest rates with a guaranteed rate of return. A great stand-alone savings option or a strong supplement to other retirement. Relationship CD IRA A high interest rate offered exclusively for Everything Checking customers. Compare the differences between a Traditional and Roth IRA. Wells Fargo Retirement High Yield SavingsExpand. Balance: $0 - $ Standard Interest Rate. %. Annual Percentage Yield (APY)Opens Dialog. %. Minimum. Roth IRA · $1, minimum balance required to open · Terms range from 7 days to 5 years · Interest rate remains fixed for the term of the IRA · Interest is. IRA CDs ; 48 Months, %, %, $ ; 54 Months, %, %, $ A Roth IRA is an investment account. It doesn't earn interest. The money in your account needs to be invested in actual securities. Funds. Find the right account for your retirement goals. roth, traditional and education iras. Fixed-Rate IRA. IRA account that earns interest at. Luana Savings Bank reserves the right to change interest rates and terms without notice. You may incur a penalty for early withdrawal and fees may reduce. IRA Rates ; 24 Months ($1, minimum), %, % ; 36 Months ($1, minimum), %, % ; 48 Months ($1, minimum), %, % ; 60 Months ($1, breplica.site provides a FREE Roth IRA calculator and other k calculators to help consumers determine the best option for retirement savings. best interests of the Fund. An investment in the Schwab Money Funds is For a Roth IRA, tax-free withdrawals of earnings are permitted five years. retirement! Keep scrolling to learn which IRA best fits you! Apply Now. Share Certificates. Greater rates than savings accounts; Fixed rates guaranteed for. IRA savings accounts may work best for people who want to diversify their IRA Certificates are savings accounts that earn a higher interest rate than you'd. Roth IRA Interest Rates ; · (% rate). 6-Month IRA / ESA ; · (% rate). 1-Year IRA / ESA ; · (% rate). 2-Year IRA / ESA ; · (% rate). As a retirement account, the IRA Savings earns more – current annual dividend rate is %. Open Account · See Rates. IRA Certificate. Lock in a high interest. High Yield IRA CDs from Discover offer both Traditional and Roth IRAs with high interest rates. View our IRA CD interest rates and calculator today. Compare IRA options. Compare Savings IRAs. Comparison Criteria Row Labels Variable Rate CD IRAs are available in both Traditional and Roth. undefined. Tax-free growth. You may not have to pay taxes every year on your Roth IRA's earnings.*. No required minimum distributions.

Can I Get Two Loans From Upstart

And if you want to apply for two different loans, there's no reason you can't do it. However, be aware that applying for and receiving multiple loans can have. Borrowers with credit scores below can still qualify for bad-credit loans from reputable lenders like Upstart and Upgrade. You are able to apply for a second loan after your most recent payment clears (14 days from the payment date). Over two-thirds of Upstart loans are approved instantly and are fully automated. have visited our site, and will not be able to monitor its performance. You will have 3 years to pay back your loan; deciding how much to borrow is up to you. Be mindful; with debt you'll incur interest. When budgeting for your. Well-qualified candidates can get a quick decision when you apply for a personal loan Available terms include one-year, two-year, four-year and five. You are able to apply for a second loan after your most recent payment is cleared (14 days from the payment date). Personal loans can be in joint names, but this depends on the lender. Some personal lenders and online lending marketplaces allow for joint applicants to. There's no official limit to the number of personal loan accounts you can have, as long as you have the income to justify all of them. And if you want to apply for two different loans, there's no reason you can't do it. However, be aware that applying for and receiving multiple loans can have. Borrowers with credit scores below can still qualify for bad-credit loans from reputable lenders like Upstart and Upgrade. You are able to apply for a second loan after your most recent payment clears (14 days from the payment date). Over two-thirds of Upstart loans are approved instantly and are fully automated. have visited our site, and will not be able to monitor its performance. You will have 3 years to pay back your loan; deciding how much to borrow is up to you. Be mindful; with debt you'll incur interest. When budgeting for your. Well-qualified candidates can get a quick decision when you apply for a personal loan Available terms include one-year, two-year, four-year and five. You are able to apply for a second loan after your most recent payment is cleared (14 days from the payment date). Personal loans can be in joint names, but this depends on the lender. Some personal lenders and online lending marketplaces allow for joint applicants to. There's no official limit to the number of personal loan accounts you can have, as long as you have the income to justify all of them.

Have no more than one outstanding loan in the Upstart Relief Loan Program at the time of application; Have no more than $ of total principal outstanding at. * - *Your loan amount will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will. will generally receive your funds two business days later. 3Sample payment example: If you are approved for a $10, loan at 10% APR for a term of Compare the best personal loan offers from multiple lenders and find the one that is right for your situation. Get matched with an offer tailored to your. You can have three personal loans at once. There is no official limit on the number of personal loans you can have at the same time. Upstart does not accept joint applications or cosigners, but LightStream does accept either. Applying for a personal loan on a joint application or with a. You can qualify for a loan from Upstart if you're at least 18, have an email address, SSN, and earn a minimum annual income of $12, You must also have a. If you are not eligible for automatic bi-monthly payments or you prefer to make manual ACH payments, you can make a split payment on your Upstart dashboard by. I am a member of two credit unions, and both have declined my application for unsecured loans. Obviously make sure you can put the student. Borrowers can get the funds they need quickly, easily, and securely with a personal loan through Upstart. If you have already received a loan on Upstart, in order to be eligible for another loan, you must: · Have made on-time monthly payments for the six previous. You may be eligible for a second loan if you. (i) have made on-time payments for your two previous consecutive payments for a three month loan or three. Can you get two loans from the same bank? Yes. Many banks and lenders will allow you to take out more than one loan, but they typically have limits. These are. How does applying for a loan affect my credit? When and how do I receive my loan funds? What is the difference between Interest Rate and APR? Can I change my. * - *Your loan amount will be determined based on your credit, income, and certain other information provided in your loan application. Not all applicants will. Upstart; (3) Cross River Bank; and (4) investors. Upstart provides a consumer-facing website through which eligible borrowers can obtain loans originated by. Stilt offers a single loan application so you can apply for a loan with + partners without impacting your credit score. Apply for loans in 2. Borrowers with credit scores below can still qualify for bad-credit loans from reputable lenders like Upstart and Upgrade. The simple facts are: personal loans are predatory and leave you in significantly more debt than you start with. dives deep into “the thorniest question” in AI lending: Does there have to be a tradeoff between accuracy and fairness? In fact, AI can improve *both* in.

Fuapf Stock

Stock analysis for Global Compliance Applications Corp (FUAPF:OTC US) including stock price, stock chart, company news, key statistics, fundamentals and. Get today's stock prices, news and investor discussion about Global Compliance Applications Corp. (OTCPK:FUAPF). Research FUAPF stock prices, stock quotes. Track Global Cannabis Applications Corp (FUAPF) Stock Price, Quote, latest community messages, chart, news and other stock related information. Check out our FUAPF stock analysis, current FUAPF quote, charts, and historical prices for Global Compliance Applications Corp stock. Stock; FUAPF; Research. FUAPF. GLOBAL COMPLIANCE APPLICATIONS CORP. Ordinary Shares. %. / (1 x 1). Real-Time Best Bid & Ask. Global Compliance Applications Corp. historical stock charts and prices, analyst ratings, financials, and today's real-time FUAPF stock price. 27 minutes ago. Stay updated on GLOBAL COMPLIANCE APP CRP (FUAPF) with the latest stock news, press releases, earnings reports and financial insights. 21 minutes ago. Stock analysis for Global Compliance Applications Corp (FUAPF:OTC US) including stock price, stock chart, company news, key statistics, fundamentals and. Get today's stock prices, news and investor discussion about Global Compliance Applications Corp. (OTCPK:FUAPF). Research FUAPF stock prices, stock quotes. Track Global Cannabis Applications Corp (FUAPF) Stock Price, Quote, latest community messages, chart, news and other stock related information. Check out our FUAPF stock analysis, current FUAPF quote, charts, and historical prices for Global Compliance Applications Corp stock. Stock; FUAPF; Research. FUAPF. GLOBAL COMPLIANCE APPLICATIONS CORP. Ordinary Shares. %. / (1 x 1). Real-Time Best Bid & Ask. Global Compliance Applications Corp. historical stock charts and prices, analyst ratings, financials, and today's real-time FUAPF stock price. 27 minutes ago. Stay updated on GLOBAL COMPLIANCE APP CRP (FUAPF) with the latest stock news, press releases, earnings reports and financial insights. 21 minutes ago.

Check if FUAPF Stock has a Buy or Sell Evaluation. FUAPF Stock Price (OTCBB), Forecast, Predictions, Stock Analysis and Global Cannabis Applications Cor. Find the latest Global Compliance Applications Corp. (FUAPF) stock quote, history, news and other vital information to help you with your stock trading and. Find the latest Global Compliance Applications Corp. (FUAPF) stock analysis from Seeking Alpha's top analysts: exclusive research and insights from bulls. Global Compliance Applications Corp. historical stock charts and prices, analyst ratings, financials, and today's real-time FUAPF stock price. 10 minutes ago. Global Cannabis Applications Stock Forecast, FUAPF stock price prediction. Price target in 14 days: USD. The best long-term & short-term Global. Discover real-time Global Compliance Applications Corp. (FUAPF) stock prices, quotes, historical data, news, and Insights for informed trading and. Global Compliance Applications Corp stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Global Compliance Applications Corp stocks price quote with latest real-time prices, charts, financials, latest news, technical analysis and opinions. Global Compliance Applications Corp. ; Market Value, $M ; Shares Outstanding, M ; EPS (TTM), -$ ; P/E Ratio (TTM), N/A ; Dividend Yield, N/A. Get stock and bond quotes, trade prices, charts and more for GLOBAL COMPLIANCE APPLICATIONS CORP. FUAPF. See the latest Global Compliance Applications Corp stock price (FUAPF:PINX), related news, valuation, dividends and more to help you make your investing. Get stock insights, analysis and discussion about Global Compliance Applications Corp. (OTCPK:FUAPF). Join the FUAPF discussion on Canada's largest online. Stock; FUAPF; Research. FUAPF. GLOBAL COMPLIANCE APPLICATIONS CORP. Ordinary Shares. %. / (1 x 1). Real-Time Best Bid & Ask. View GLOBAL COMPLIANCE APPLICATIONS CORP (FUAPF) stock price, news, historical charts, analyst ratings, financial information and quotes on Moomoo. Find the latest Global Compliance Applications Corp. (FUAPF) stock quote, history, news and other vital information to help you with your stock trading and. Here are FUAPF's fundamentals. Value. Is this stock cheap or expensive? Forward P/E. Reveal. Enterprise Value to Sales. Reveal. Free Cash Flow Yield. Reveal. Get Global Compliance Applications Corp (FUAPF:OTCPK) real-time stock quotes, news, price and financial information from CNBC. Global Compliance Stock (OTC: FUAPF) stock price, news, charts, stock research, profile.

Robinhood Federal Id Number

Robinhood Securities Federal ID Number: ; Robinhood Crypto Federal ID Number: ; Apex's Federal ID Number: Advantages of Using. Robinhood Securities, Llc is a corporation in Lake Mary, Florida. The employer identification number (EIN) for Robinhood Securities, Llc is Payer's Federal Identification Number: Payer's Name, Street, City, State, Zip Code APEX CLEARING ONE DALLAS CENTER N. ST. The Robinhood Money spending account is offered through Robinhood Money, LLC (“RHY”) (NMLS ID: ), a licensed money transmitter. RHF, RHS, RHC, and RHY. Robinhood represents that it currently tracks a number of metrics regarding or tax credit with regard to any state, federal or local tax for any. If you notice your social security number is incorrect on your Robinhood tax identifying every tax write-off automatically. This helps freelancers and. Federal Tax Identification Number: Business Name: ROBINHOOD MARKETS, INC.. Address: MENLO PARK, CA. Make a Gift With a Donor-Advised Fund ; Legal Name: Robin Hood Foundation ; Address: Broadway, 9th Floor, New York, NY ; Federal Tax ID Number: You can import your Consolidated Form into common online tax providers, such as TurboTax and H&R Block. Robinhood Securities Federal ID Number: ; Robinhood Crypto Federal ID Number: ; Apex's Federal ID Number: Advantages of Using. Robinhood Securities, Llc is a corporation in Lake Mary, Florida. The employer identification number (EIN) for Robinhood Securities, Llc is Payer's Federal Identification Number: Payer's Name, Street, City, State, Zip Code APEX CLEARING ONE DALLAS CENTER N. ST. The Robinhood Money spending account is offered through Robinhood Money, LLC (“RHY”) (NMLS ID: ), a licensed money transmitter. RHF, RHS, RHC, and RHY. Robinhood represents that it currently tracks a number of metrics regarding or tax credit with regard to any state, federal or local tax for any. If you notice your social security number is incorrect on your Robinhood tax identifying every tax write-off automatically. This helps freelancers and. Federal Tax Identification Number: Business Name: ROBINHOOD MARKETS, INC.. Address: MENLO PARK, CA. Make a Gift With a Donor-Advised Fund ; Legal Name: Robin Hood Foundation ; Address: Broadway, 9th Floor, New York, NY ; Federal Tax ID Number: You can import your Consolidated Form into common online tax providers, such as TurboTax and H&R Block.

The employer identification number (EIN) for Robinhood Securities, Llc is EIN for organizations is sometimes also referred to as taxpayer. I tried a phone call, put my number in and about an hour and half later got a call back. There's a tax certification link in Robinhood to. Robinhood Crypto Spending/Debit: Robinhood Money Credit Card: Robinhood Credit Support: Earnings, inflation data, the impending Fed rate cut — we're talking. Log in to your Robinhood account. · Click on the Retirement tab. · Click on Settings. · Scroll down and click on Account Numbers. · Your Robinhood accounts will. Keep in mind. This is for informational purposes only and aimed at answering questions regarding the tax document you may receive from Robinhood. Step 2: Fund your Robinhood account: Robinhood's Note that even though you provide a tax ID such as a Social Security number, this application will not affect. A special interest's lobbying activity may go up or down over time, depending on how much attention the federal government is giving their issues. Robin Hood Foundation's Tax ID number is Consistent with safeguarding its own interests, Robin Hood tries to make arranging a gift for the. Profile managed by nonprofit | Is this your nonprofit? An EIN is a unique nine-digit number that identifies a business for tax purposes. Organization Mission. ID, and a facial recognition scan from Robinhood. I should not have to federal taxes at the end of year. I have been using this product almost. Robinhood Help Center | Get answers. number (SSN), individual taxpayer identification number (ITIN), adoption taxpayer identification number (ATIN), or employer identification number (EIN)). The Employer Identification Number (EIN) for Robinhood Markets, Inc. is EIN numbers are also referred to as FEIN or FTIN. A TIN can be either your social security number (SSN), employer identification number (EIN), or individual taxpayer identification number (ITIN); or; Under the. Documents and taxes. Taxes and forms How to access your tax documents Tax documents FAQ Crypto tax FAQ How to read your How to read your R and You updated your social security number. Carefully review your tax forms to ensure all the information is accurate. If you find an error, read on to learn. EIN is given by the Internal Revenue Service is a number and used by companies, businesses, individuals. to TurboTax, you wont need. Robinhood Tax Id Not file state tax return for the state where Robinhood Employer Identification Number: EIN/TAX ID. The IRS deadline for Robinhood to send your tax forms is January 31 for Form R and May 31 for Form for this tax year. For specific questions about. MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF CLASS A COMMON STOCK As a further sign of our relevance today, Robinhood reached the.